Foreclosure pipelines are re-filling nationwide.

Foreclosure pipelines are re-filling nationwide.

According to data from RealtyTrac, a national foreclosure-tracking firm, the number of foreclosure filings dipped below 192,000 in July 2012, a 3 percent decrease from the month prior.

RealtyTrac defines a “foreclosure filing” as any foreclosure-related action, including a Notice of Default, a Scheduled Auction, or a Bank Repossession.

July marks the 22nd straight month during which foreclosure filings fell on a year-over-year basis. At some point soon, however, that streak may end. This is because, for the third straight month, on an annual basis, foreclosures starts are on the rise.

More than 98,000 homes started the foreclosure process in July, a 6 percent increase from July of last year. Connecticut, New Jersey and Pennsylvania experienced the biggest increases, rising 201%, 164% and 139%, respectively.

Each is a judicial foreclosure state, which means that foreclosures must go through the state court system prior to auction.

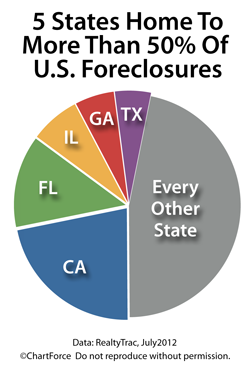

Nationwide, just a few states accounted for the majority of July’s total foreclosure activity. 5 states were home to more than half of all tracked activity, according to RealtyTrac.

- California : 21.9 percent

- Florida : 13.3 percent

- Illinois : 7.2 percent

- Georgia : 5.7 percent

- Texas : 5.2 percent

Collectively, these 5 states represent just 33 percent of the nation’s population.

In contrast to the five states above, the bottom 14 states accounted for just 1 percent of the nation’s foreclosure activity, led by North Dakota. In North Dakota, just 3 foreclosure filings were made in July. Other “fewest foreclosure” states in July included District of Columbia (7 filings), Vermont (31 filings), and South Dakota (63 filings).

For home buyers in Phoenix , with more foreclosed properties expected to go for sale this year and next, there will be some excellent “deals” and discounts — foreclosed homes typically sell at discounts of 20% or more as compared to comparable, non-distressed homes. However, foreclosed homes are often sold as-is, which means they may have defects.

Before placing a bid on a foreclosed home, therefore, make sure to have an experienced real estate agent on your side. Buying a foreclosed home may save you money at your closing, but may cost you money longer-term.